SEIZING THE WORKING CAPITAL B2B REVENUE OPPORTUNITY

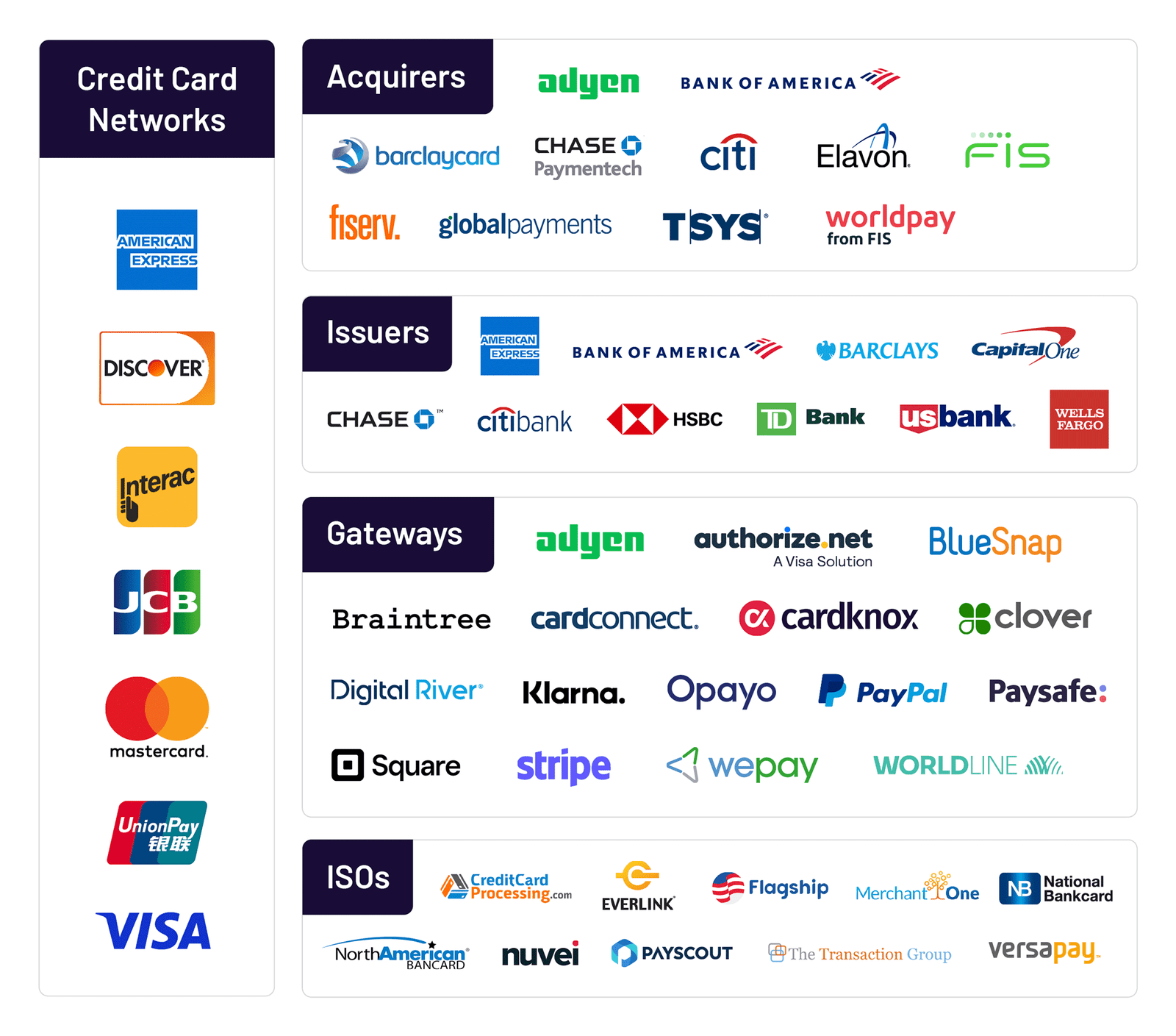

Figure 1. The Digital Payments Ecosystem. Source: Cardknox

Not a day goes by where I don’t read about the huge opportunity to maximise revenues from the U$79.3* trillion environment of Business-Business (B2B) payments.

This coupled with the daily cross border FX market where U$7.5^ trillion is transacted each day, offers opportunities for payment innovators and established financial services companies alike.

But first let’s clarify some key terms around working capital and B2B transactions.

Working capital` is the amount of an entity’s current assets minus its current liabilities and an important aspect of a firm’s operations.

The result is considered a prime measure of the short-term liquidity of an organisation.

Insufficient levels of working capital can harm a company if it cannot meet its short-term obligations, leading to product shortages, sales slowdowns, and, in the extreme, bankruptcy.

The operational efficiency, credit policies and payment policies of a business have a strong impact on its working capital.

Net working capital (NWC) is almost always used interchangeably with working capital.

Some analysts define NWC more narrowly to provide a more comprehensive picture of a company’s health. In this case, the formula excludes cash assets and debt liabilities:

Net Working Capital = Accounts Receivable + Inventory – Accounts Payable

Cash conversion cycle (CCC)” is a metric that expresses the time (measured in days) that it takes for a company to convert its investments in inventory and other resources into cash flows from sales.

Also called the net operating cycle or simply cash cycle, CCC attempts to measure how long each net input dollar is tied up in the production and sales process before it gets converted into cash received.

Figure 2. Overview of a typical corporate client financial supply chain where banks and payment innovators seek to add value and win business.

Seizing these working capital opportunities requires a deep understanding of how businesses and industries operate.

The diagram shown above, gives an example of the entire value chain of an organisation and how all aspects of financial operations fit together.

Only by understanding these payment flows intricately can one then determine where and how B2B payment flows can optimally be captured.

New payment flows are captured through a combination of capabilities, some of which include; low friction, rich data, strong transaction traceability, smart partnership management and deep insights. To learn how your organisation and sales team can seize some of the U$79 trillion global B2B payment flow opportunity, reach out for a confidential discussion mark@markswain.com.au

References

* https://www.fortunebusinessinsights.com/b2b-payments-market-108853

^ https://www.reuters.com/markets/us/global-fx-trading-hits-record-75-trln-day-bis-survey-2022-10-27/

` https://www.accountingtools.com/articles/working-capital

“ https://www.investopedia.com/terms/c/cashconversioncycle.asp

Join Our Newsletter

Sign up for insights into key banking and sales trends below.